The Awareness

"Awareness" is the time ranging from November 2008 and the first quarter of 2009.

"Battling the worst financial crisis since the 1930s has dominated my waking hours for the last 21 months" (Ben Bernanke, May 2009)

Inflation Expectations

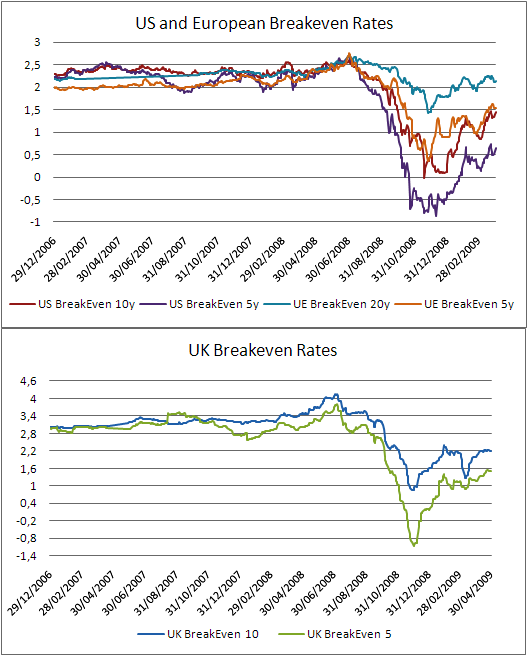

Break-evens inflation is the usually positive difference in yield between the safe treasury bond and the supersafe inflation-linked bond (tips). It's a gauge of expected inflation but faces a liquidity concern: government bonds issues are much larger and the secondary market is deeper than for tips.

The recent shifts of break-evens rates' provide an interesting point of view for analyzing the inflation expectations topic, as detailed in Hordahl's paper "Disentangling the drivers of break-evens rates".

Observing negative break-evens in developed countries issues (up to 5 years in US and UK) and historically low rates in longer maturities, we derive that:

- though safer than govies, tips yields incorporated negative short term inflation expectation;

- treasuries prices were affected by a consistent liquidity premium.

UK short and medium term inflation expectation have been exceptionally volatile, slumping even more than US ones.

Corporate Bond Market

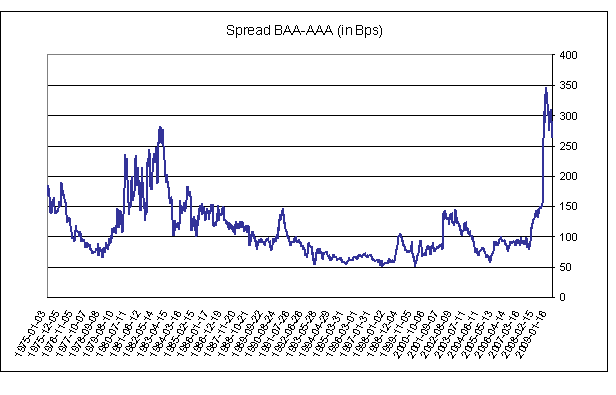

The Spread between BAA rated corporate bonds and Triple-A rated increased significantly during the last part of 2008, like many other indicators of credit risk, but still remains at very high levels and well above its historical average.

Money for free? The liquidity issue

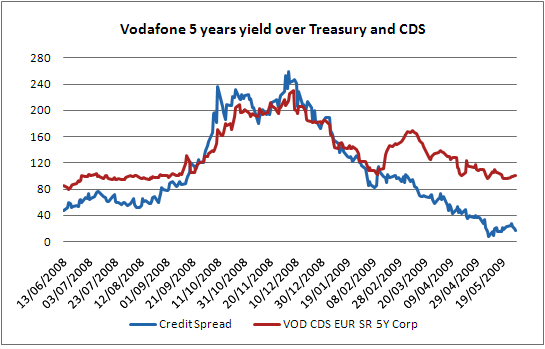

Let's compare the extra yield requested on Vodafone 5 years corporate debt over the UK Treasury 5 years and the price of risk reflected in its quoted CDS. The CDS coupon due for protection against default in 2 periods between September and December 2008 is lower than the corresponding credit yield for the same company and maturity. Buying both the corporate bond and the CDS, it was possible to earn the yield and protect the credit risk while at the same time still bringing some risk-free money home.

The link to CDS Puzzle article provides some deepening in the CDSs pricing problem and their risk/reward asymmetry.

Stabilizing the Money Market

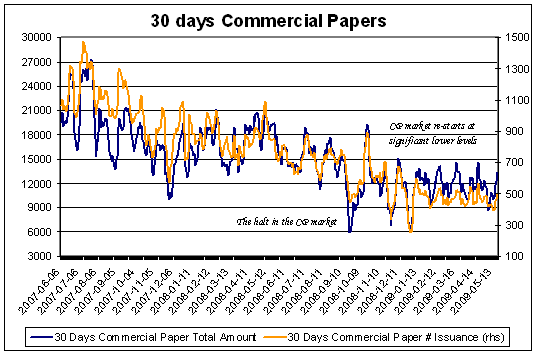

The Commercial Papers and Asset Backed CPs market freezed suddenly in September/October 2008 leaving CPs issuers and financial intermediaries in troubles. This crucial market thawed only after authorities intervention, mainly via the CPFF and AMLF programs.

Monetary Authorities responses

Actions taken by Monetary Authorities for facing the liquidity crunch have been unprecedented and sometimes dramatic. Central Banks understood that strong coordination between them lead to major effectiveness (see section Authorities' actions for details).

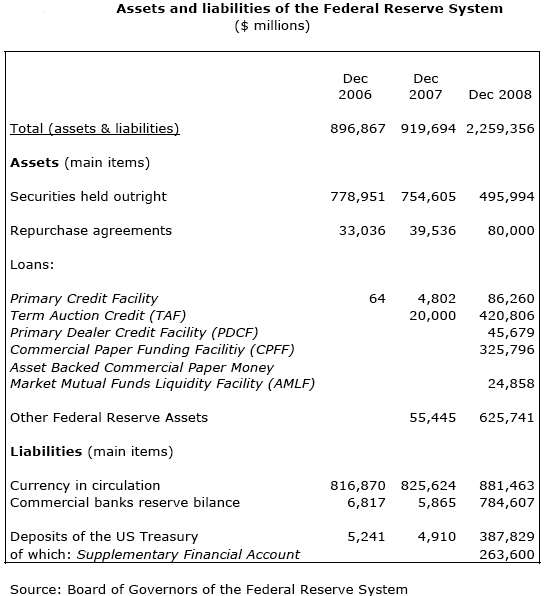

The Balance Sheet of the Federal Reserve over time, increased according to these extraordinaly measures. The ledger "other Fed assets" concern mainly the swap lines opened with all major CBs. The big risk underlying this balance sheet arises more from the composition of the assets -how many toxic and non marketable securities are in- than from its size.

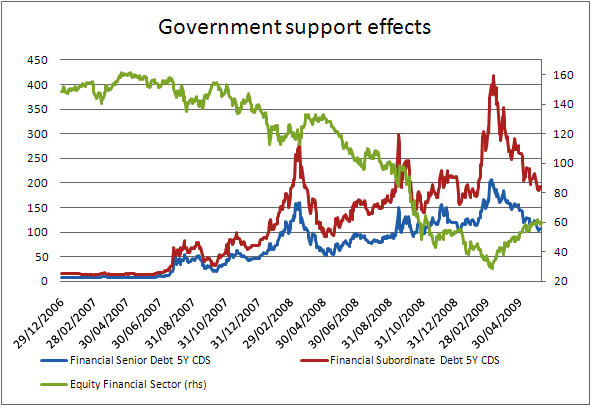

After November 2008, while existing authorities guarantees and expectations of further government support measures served to limit further downside movements in banks stock prices, subordinated credit spreads remained under great pressure from uncertainty about the government interventions in lower-seniority debt instruments, including hybrid securities, and senior debt spreads were pushed higher as well.<?xml:namespace prefix = o />

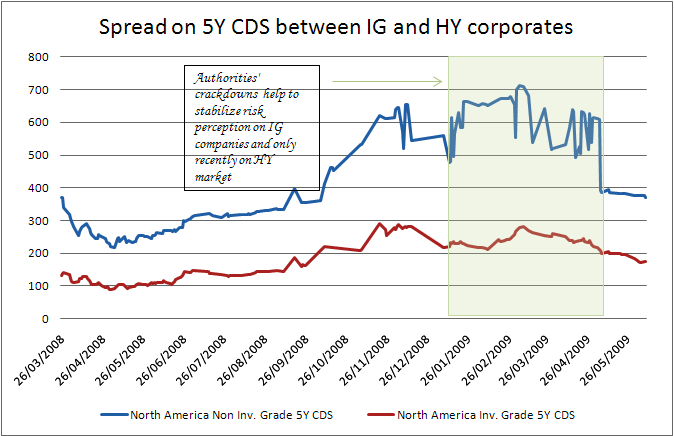

The desired effect on the financial system took a while to deploy. The chart below shows that the risk perception over high yield corporates, over a time period of 5 years, retreats to pre-crisis levels only recently.

Risk price of investment grade companies, instead, has been quickly stabilized and its volatility has been kept relatively low.

Fx Market

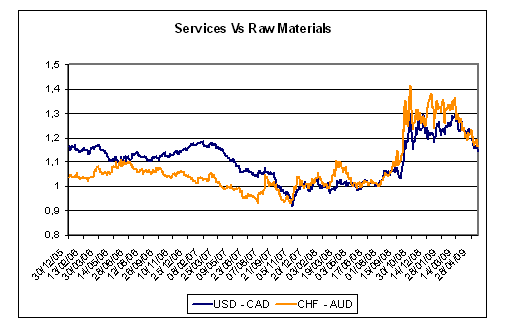

Raw materials exporting countries vs industrial and service provider countries. The Fx market shows that capitals outflow raw material rich countries, like Australia and Canada, redirected to industrialized economies and haven currencies.

CDS: the cost of public intervention

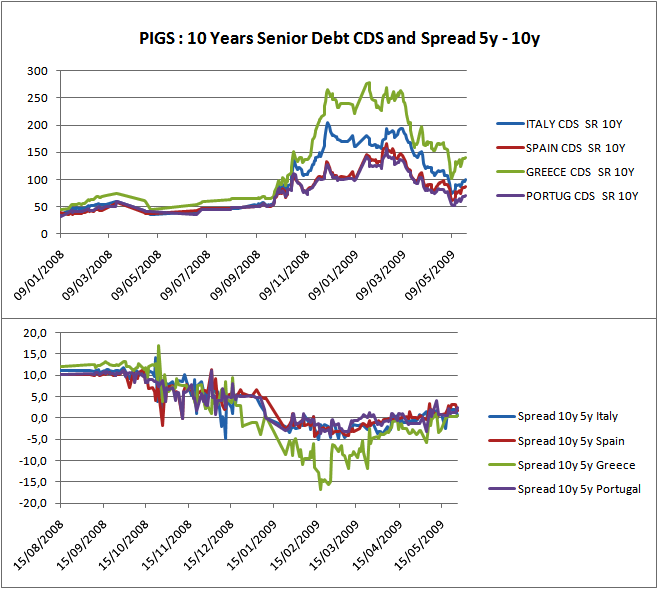

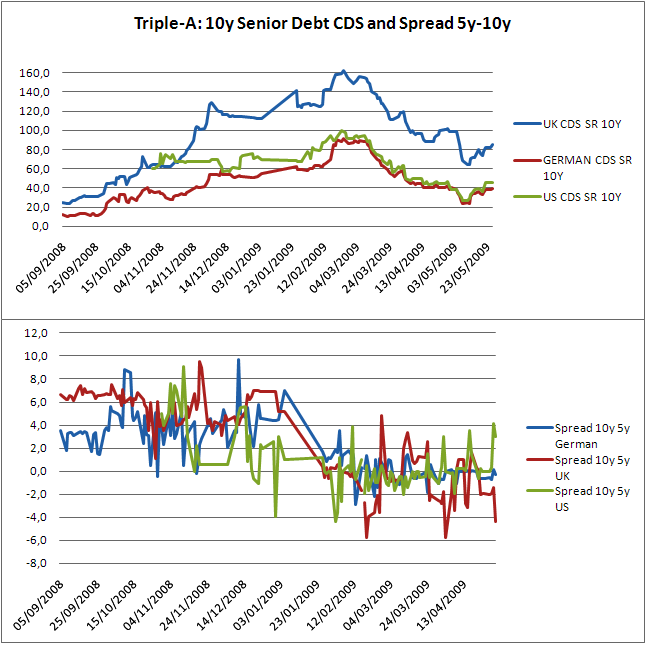

Government bond market: PIGS and Triple-A countries

Effects became visible in late November and the following months, when everybody was aware that governments used several percentage points of their GDP in order to stabilize the credit market and rescue financial intermediates.

Spreads on sovereign CDS continued to rise over the period, spiking in January with Greece, Portugal and Spain being downgraded by S&P.

Both in the PIGS chart and in the UK-German-US one, the spread in Bps between the 10 years and the 5 years cost of protection narrows until turning negative: the default probability estimated for these countries is higher in the medium term than in the long run.