Landing

How long does the economy take to recover and will there be a new economic paradigm?

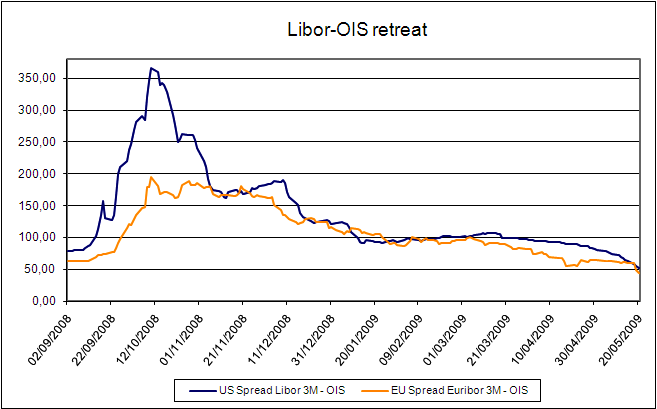

The Libor-OIS spread turned to last year's levels, while credit spreads turned to pre-Lehman levels (with S&P quoting circa 1200); it's worth saying that now we have both recession and monetary expansion, while before the Central Banks were still tightening monetary policy.

<?xml:namespace prefix = o />

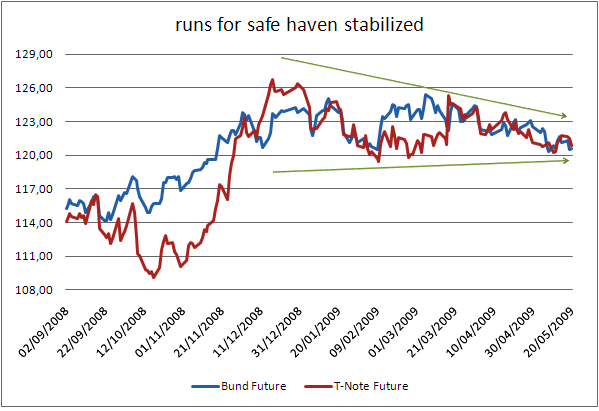

The run towards safe havens to put money halted in 2009 and bond future prices remain steady to high, levels implied by the expansionary interest rates policy. It is important to observe that volatility has slowed considerably.

What if the housing market recovers?

Housing starts and sales appear to be stabilizing and homes no longer look expensive. Now a partial rebound in mortgage rates threatens the low price maintenance and limits the refinancing ability of indebtness households.

The housing recovery hasn't even started and it's already at risk. The "Fed Dilemma" paper goes deeper into this sentence.

Do we expect an inflationary environment in the next years?

The measures of monetary authorities and government actions to face the credit and economic crisis are deemed to provoke a strong inflationary scenario in the world. I think that even if the amount of money pushed into the system is huge, inflationary pressures can be managed because:

- central banks are ready and willing to drain the excess liquidity they injected and are attentively monitoring the ongoing concern;

- the large use of public debt in financing troubled institutions and support markets doesn't lead to inflation scenarios.

What about the global imbalances?

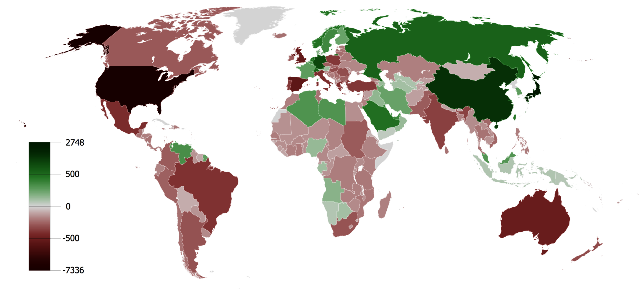

The world may be delevering a crisis solution, but as far as external imbalances go, we're not in presence of a real way out: the core imbalance in the global economy, China's surpluses and the structural deficits in the US and other economies, still remains to be addressed.

For China, rebalancing, when it does come, will probably primarily involve the supply side, constraining investments and reducing excess capacity: all these effects can be triggered by the appreciation of the Renminbi. What if the Renminbi is allowed to freely float?

Some final questions

- What are the crisis' implications for globalisation?

I guess that the massive injection of government funds has partly de-globalised finance, at great cost to emerging countries. Most of them will conclude that hoarding massive foreign currency reserves and limiting current account deficits is a sound startegy.

- Has the role of emerging countries changed?

A deep crisis is able to modify the global political order.

Emerging countries, China above all, are going to become central players, with India waiting in the wings.

- Is this crisis the end of capitalism?

Capitalism will survive: free-market believers insist that the failure lays on the regulator side rather than on the market itself.

Instead, it may lead to the end of a hegemonic market model and the surge of new market economy adapted on each countries own traditions.

The current crisis has accelerated some trends and proved others, such as those in credit, unsustainable.