_StockMarkets

Stock Market prices usually anticipate the concerns both in the real economy and in the financial sector itself.

Equity market indices

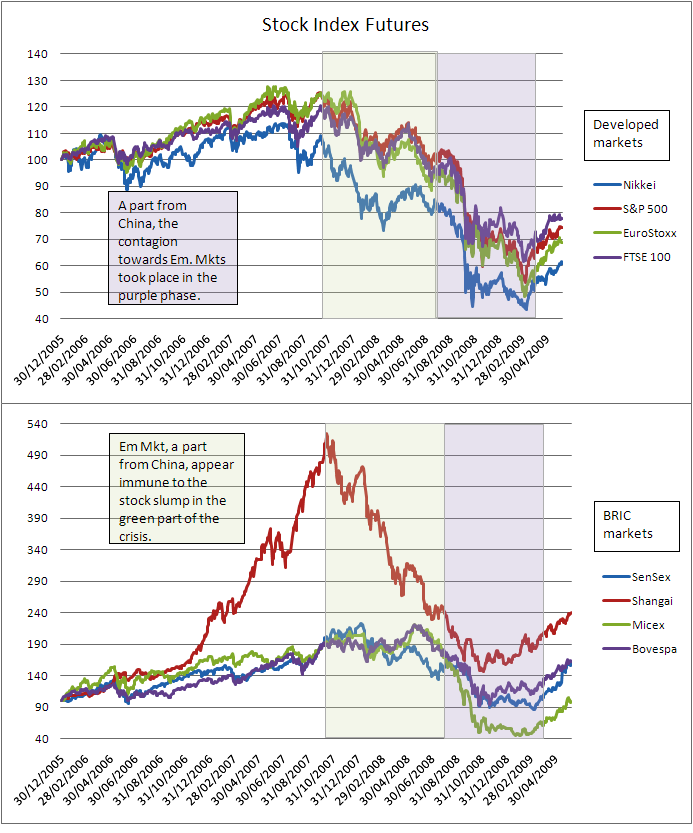

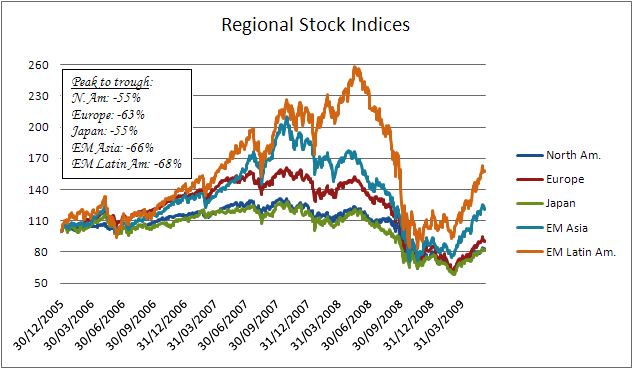

The violence of stock futures price correction has been memorable; it can be divided into at least 2 phases. During the first period, emerging markets generally performed better because of their little exposure to the distressed assets that plagued the major industrial economies.

The severe and broad-based nature of the economic downturn came up only during the acute phase of the crisis, infecting mostly emerging markets, while for the period "mid-2007 to mid-2008" circa, they appear to weather the turmoil relatively well.

Then, macroeconomic stress spillovers flowed in the last part of 2008 through slowing export demand, worsening trade balances, deteriorations in economic activity and capital outflows. The vulnerability of the currencies of emerging countries weakened their ability to finance their deficits and the service of foreign currency debt, leading to sharp fx market tensions.

The banks, mostly subsidiaries of western europe groups, were in turn exposed to the worsening outlooks in their host markets.

Equity sector indices

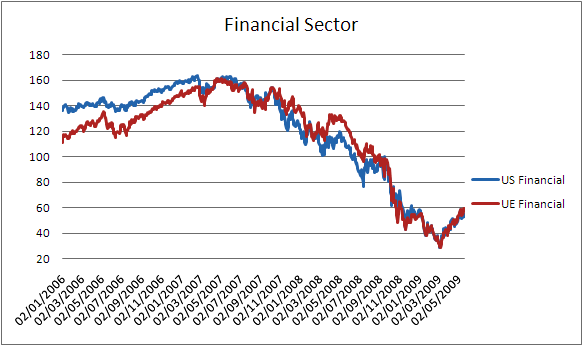

Banks and intermediaries have not only been hit hard by the crisis, but have been the nucleus where the big bang boomed (see the article: putting a bomb in the center of financial system).

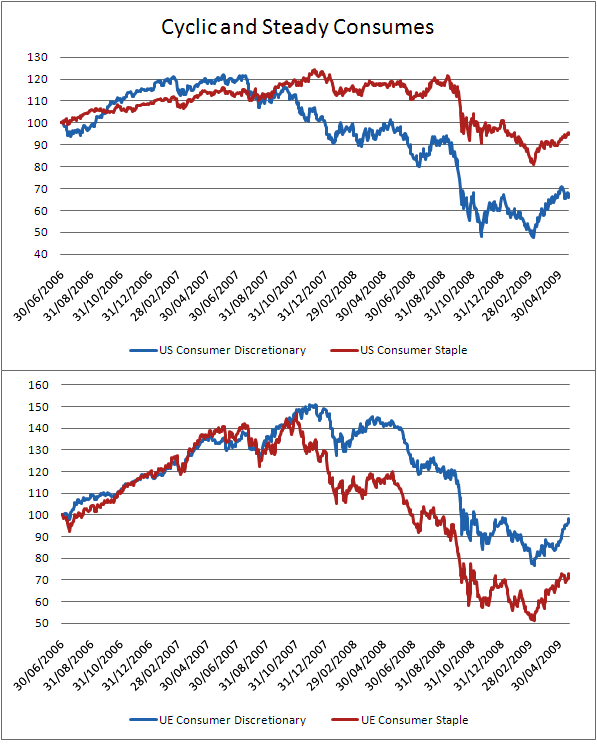

Panic spreads to a large set of consumers and both staples than discretionary sales are hit heavily. In Europe, differently from expected, non-cyclic consumes index fell more than those that were cyclic.

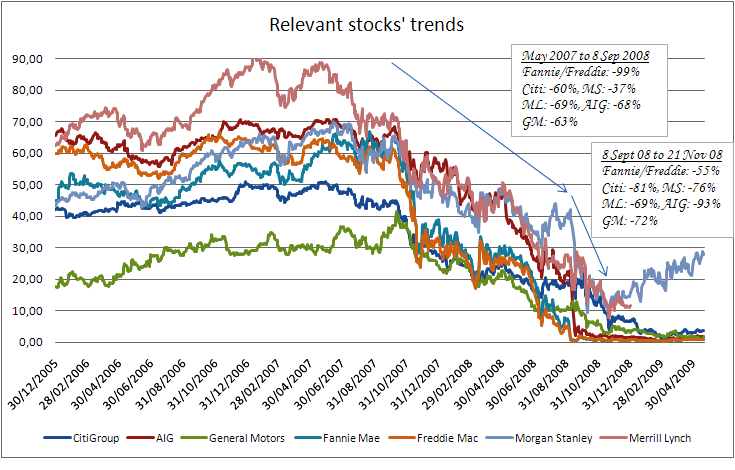

Single stocks going south

Heavy selling in the financial sector (paired by automakers) shares led the way down, fuelled by revelations of outsize quarter losses on both sides of Atlantic, new instances of government interventions, outright nationalisations, concerns about the state of the trouble sector and investors waning equity appetite.