_USMoneyMarket_Funding Non US Banks

the iceberg impact

The global thaw of US dollar funding

The loss of confidence in dollar money market funds amplified the financial instability arising from Lehman Brothers bankruptcy. It's worth noting that the run on these funds coincided with the deterioration in the global interbank market and induced the major CBs to react rapidly in an unprecedented way.

What is the relationship between the US money market and the transmission of dollars in global financial institutions?

As MM funds' assets grew strongly, the search for alternative and more profitable "cash" investments led to ABCP (asset backed commercial paper) and bank's CD (certificate of deposit) markets. Prior to mid 2008 US Money Market funds hold in average 40% of European and other non-US countries paper, leaving European banks dependent on MM funds asset allocation for their unsecured dollar funding need.

The following Lehman failure triggered large redemptions, and in some case runs, in these funds, with investors flying to the quality of government funds. The money market suddenly froze, causing unprecedented strains in the interbank market of dollar funding.

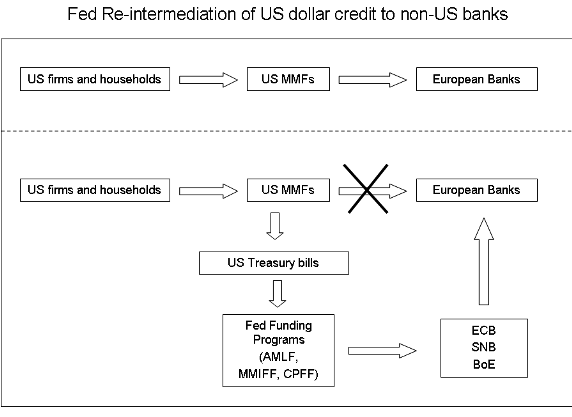

The following chart shows the normal capital flows and the alternative that the system had to develop in response to the credit freeze.