Sowing the crisis' seeds

The roots of the current crisis are to be found in the time preceding 2007, it is difficult to say how long in the past.

" The problem was much broader than subprime lending. Large inflows of capital into the US and other countries stimulated a reaching for yield, an underpricing risk, excessive leverage and the development of complex and opaque financial instruments that seemed to work well during the credit boom but have been shown to be fragile under stress" (Ben Bernanke, October 2008)

The virtuous circle

We are able to seek out the seeds of the credit crisis in the US economy particularly in its predominant economic thought and in its relative economic stability and wealth during the previous decades.

<?xml:namespace prefix = o />

A historically cheap money cost has caused over time:

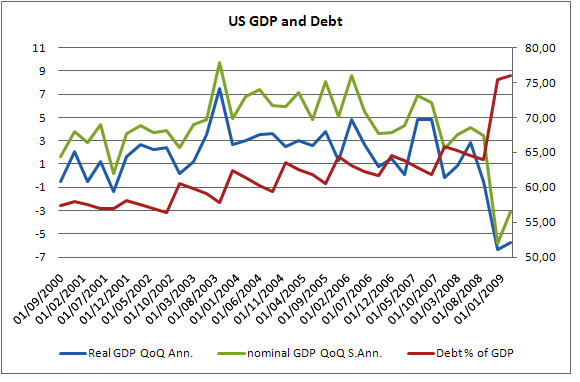

- fastest GDP growth rates and an high level of indebtness:

- commodities price boom (see section How it all began)

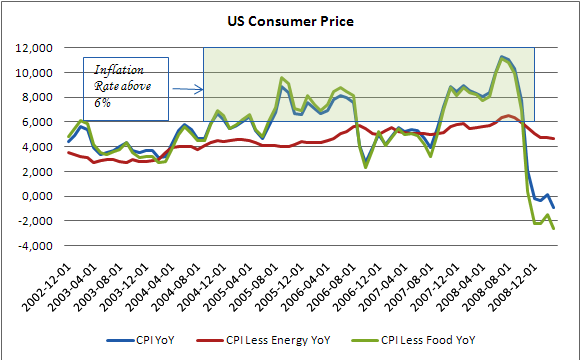

- excess inflationary pressures:

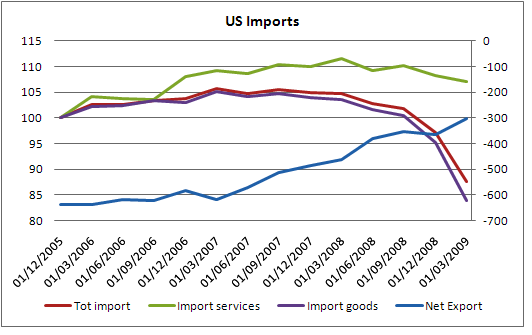

- sustained imports:

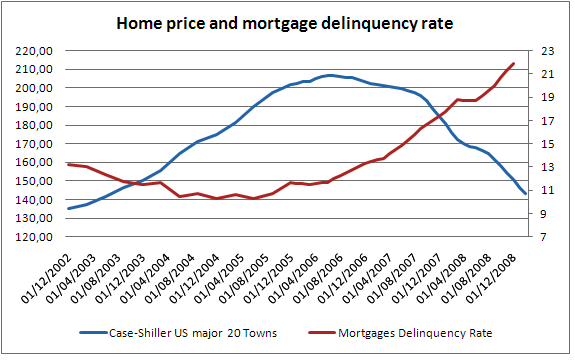

- easier credit conditions, especially in the housing market: US Housing market experienced a bubble, like Japan in the '90s. Continuously increasing houses' value gave an erroneous perception of household wealth and gave borrowing access to subprime individuals: lenders virtually hedged the risk following the conviction that foreclosure money more than offset lended money. Unfortunately, this theory began to unravel in mid 2006.

It seemed to be a virtuous circle, dubbed Bretton Woods II. Actually BW II was relying on:

- Ever-greater US trade deficit

- Global imbalances

- Global confidence in the US dollar

Single investors' interests and global interests were supposed to be aligned and self-fulfilling in the search for the maximum yield. This is the foundation of the Rational Expectation Theory, which has been predominant so far. The recent crisis, the panic oriented behaviour and the new order the financial market is looking for, may trigger the development of alternative theories. See the article on the Reflexivity Theory as an example.

Credit boom

The credit boom was mainly due to:

- a shift outside the regulated banking system (Glass-Steagall Act revision in '99);

- lasting times of negative real interest rates (disinflation);

- a trading through innovative instruments and on artificial platforms, resulting increasingly disconnected from underlyings;

- loss of discipline by investors and traders, seeking for higher yields on the M/L term while borrowing in the short run.

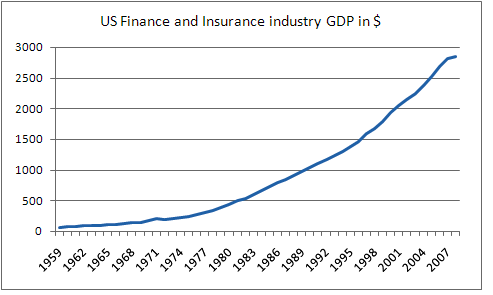

Financial assets contribution to US GDP

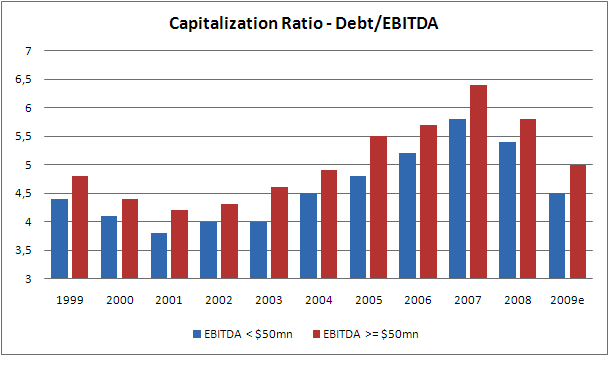

Companies' capitalization and indebtness

- easier credit conditions, especially in the housing market: US Housing market experienced a bubble, like Japan in the '90s. Continuously increasing houses' value gave an erroneous perception of household wealth and gave borrowing access to subprime individuals: lenders virtually hedged the risk following the conviction that foreclosure money more than offset lended money. Unfortunately, this theory began to unravel in mid 2006.

- sustained imports:

- excess inflationary pressures:

- commodities price boom (see section How it all began)