The Iceberg Impact

We can refer to the period starting from Bear Stearn collapse, mid March 2008, and the weeks subsequent to Lehman Brothers / Washington Mutual failures, October 2008.

"The financial turmoil intensified in recent weeks, as investors confidence in banks and other financial institutions eroded and risk aversion heightened. Conditions in the interbank lending market have worsened, with term funding essentially unavailable. Withdrawals from prime money market mutual funds, which are important suppliers of credit to the commercial paper market, severely disrupted that market" (Ben Bernanke, October 2008)

The Black Swan in the Money Market

Ted Spread is a gauge of liquidity stress in the money market: it's the difference between Interbank Loan Rate and Short Term Treasury Rate. It captures:

-

the downward pressures on T-bills rates due to "flight to haven"

- the loss of confidence in the interbank overnight market

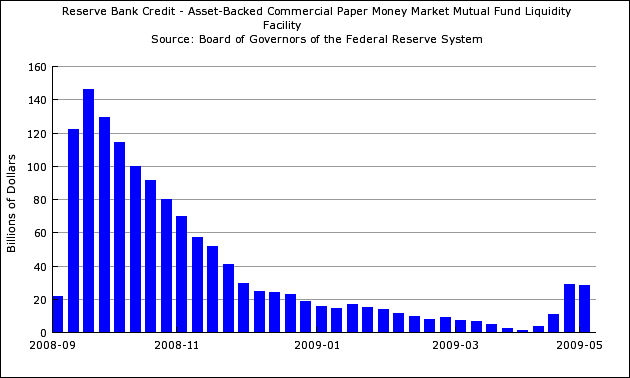

The Monetary Policy response Fed, ECB, BOE and others CBs around the world implemented several programs in response to the shocks in the money market and the lending activity. The specific program the Fed set up for backing the US money market is ABCP-MMLF.

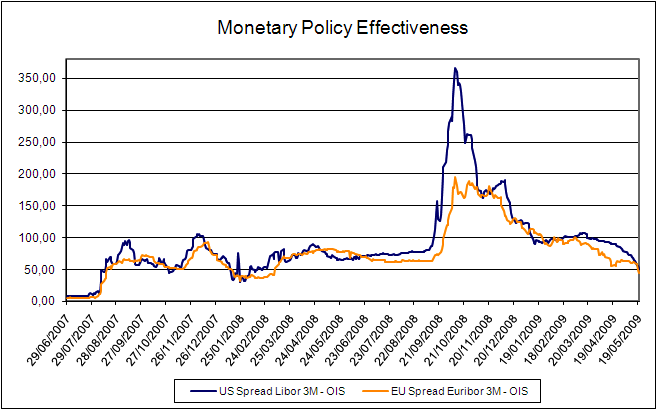

Read more on how the US money market funds provide dollar funding to non-US banks. The halt of these flows has been a major worry for the Fed and the other CBs. When will the super-expansive monetary policies become effective? Libor-OIS spread provides the answer: the huge efforts monetary authorities did starting from September 2008, produce results 6 months later.

Read more on how the US money market funds provide dollar funding to non-US banks. The halt of these flows has been a major worry for the Fed and the other CBs. When will the super-expansive monetary policies become effective? Libor-OIS spread provides the answer: the huge efforts monetary authorities did starting from September 2008, produce results 6 months later. Panic strikes everything

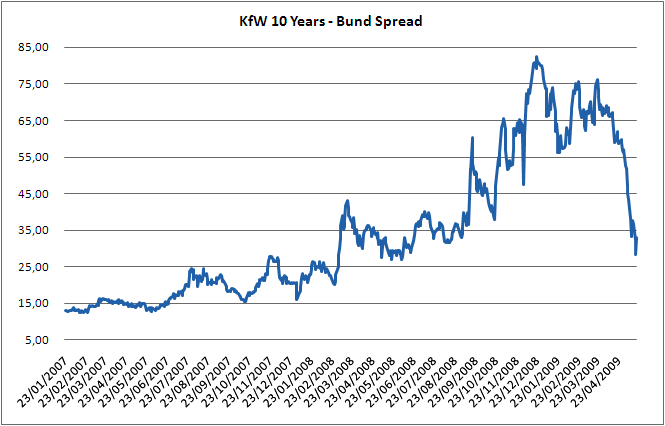

KfW is a bank owned by the Federal Republic of Germany whose debt is fully and directly guaranteed by the State. The Spread between 10-years issues of KfW and Government Bund widens considerably until march '09 suggesting that liquidity and other factors distinct from credit worthiness were the key drivers.

The recent back track of the Spread is due more to higher Bund yield than though decreased KfW bond yield.

Treasury Repo Market

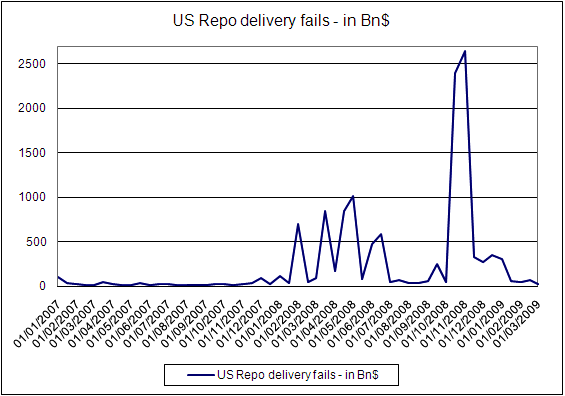

Settlement fails in US Treasury Repos reached a record high in October 2008, giving evidence of terrible tensions in funding markets. A settlement fail occurs when a security is not delivered on the date agreed, often in connection with a repo transaction.

The subsequent improvement in the settlements is due to lower repo trading volumes and actions taken by the TMPG (Treasury Market Practices Group) sponsored by the NY Fed such as the introduction of fix penalties.

Private Equity Market

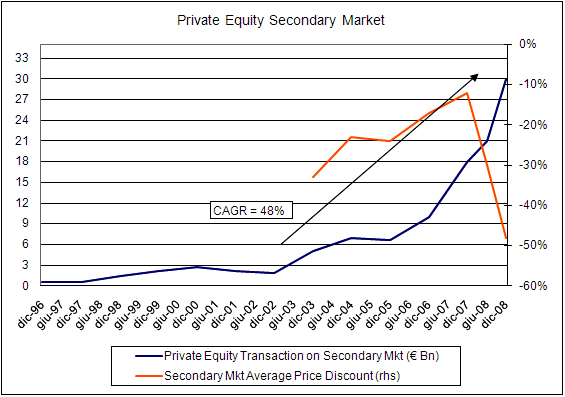

Secondary market transaction volume soared to historical highs, following the over-allocation in the PE market during the 2005-2007 period and investors distress to meet their obligations. Private Equity investors, including fund of funds, cannot withdraw their commitments until the fund expiration; for liquidity reasons a secondary market of private equity funds quotes is born . Obviously, the cost of cash, the liquidity premium, is the average discount at which the quotes are sold.

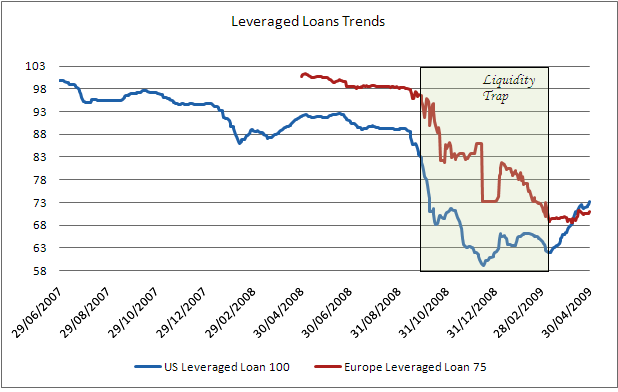

Senior secured first lien debt value, historically quoted at par, plummets by 35% in few weeks. The disrupted credit market and subsequent freeze of liquidity lead to an epic destruction of capitals both in the US and Europe.

Fx Market teachings

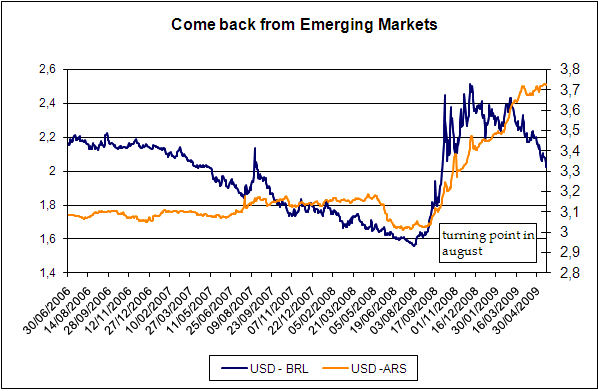

Green dollars back home from emerging countries' investments

The inflection point is August 2008. The investors' risk appetite fall anticipate the big bang of mid September and October.

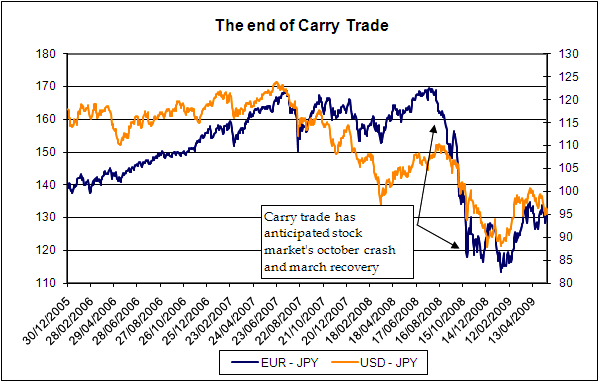

The end of Carry Trade

Carry trades: investors world wide borrow money at almost zero yield in Japan and deposit them in higher yield countries. When their risk appetite wanes, the positions are quickly unwinded and capitals flow back into the safe Yen.

CDS: the cost of risk

Let me introduce this section with a link to a sharp and funny article, Seated on the iceberg top.

Credit officers in financial institutions believed to keep the risk of their CDS books under control by leaving a small percentage of exposure on bank accounts, based on some risky scenarios. Whatever so-called stress scenario has been simulated by the bank officers, it could not take into account the failure of the bank itself.

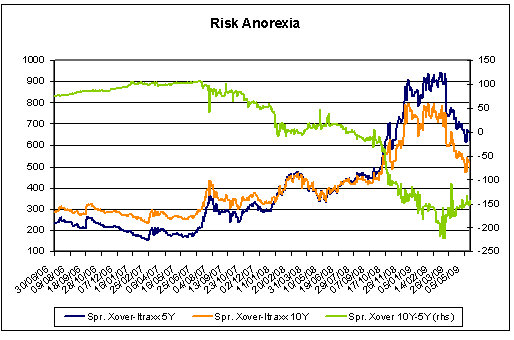

In the corporate bond market we could note that sub-investment grade companies cost of borrowing compared to the cost of creditworth firms (spread Xover-ITraxx) fivefold its 2007 levels.

Moreover, the difference between the 10 years and 5 years cost of protection on High Yield Corporates, went negative: the survive probability if these companies over the next 5 years is low and it is priced accordingly.