Evolution of the Crisis

The credit crunch and the financial crisis

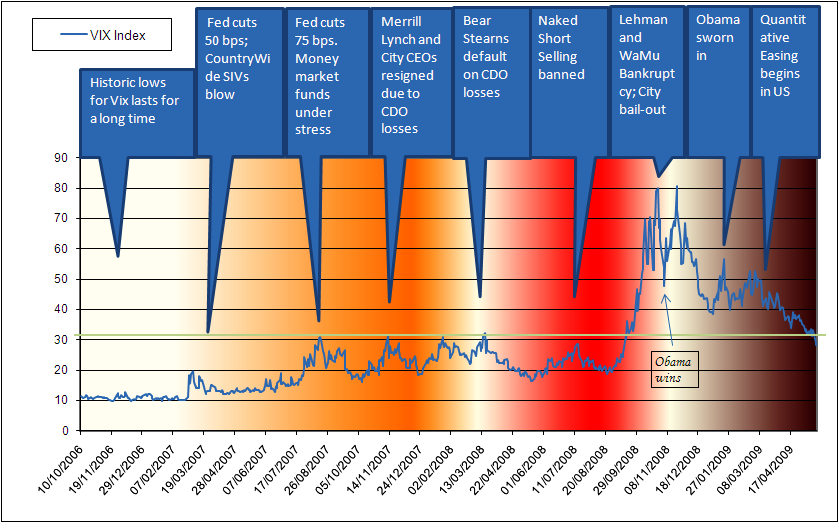

Beyond all analyses on the roots, the trends, the way-outs of the credit crunch, the financial crisis has been a worldwide nervous breakdown.

The psychological point of view is the one we choose for introducing the crisis.

Market volatility is drawn by financial players' nervousness.

The CBOE Volatility Index (VIX) is a measure of market participants' expectations of near-term variability, as conveyed by the S&P 500 Index option prices on quarterly averages.

|

Ante 2007 |

Early 2007 to Early 2008 |

March 2008 to Oct 2008 |

Nov 2008 to 1st Q2009 |

|---|---|---|---|

|

US GDP and Debt US Consumer Price Index US Imports and net Export Home Price & Delinquency Rate<?xml:namespace prefix = o />

Capitaliz. Ratio: Debt/EBITDA |

Us industrial production and output gap US current account Fx Mkt: Dollar vs Asian currencies

US Housing Market

Oil, Gold and Food prices

Yield Curve Spreads

Money Market Funds

|

Ted Spread

Fed Facilities

Libor-OIS

KfW Spread

Repo delivery fails

Private Eq. Transactions

Leveraged Loans

Fx Market

CDS Indexes |

Inflation Breakevens

BAA-AAA Spread

Money for free

Commercial Papers Mkt Fed Balance Sheet

Financial Senior and Sub CDS

IG vs HY CDS

Fx Market

Sovereign CDS & Spreads |

...guessing the future: How it all ends section

Chronology of outstanding facts

Follow the links for an exhaustive chronology of the outstanding facts clustered into 4 main areas.

Market's Events

(Housing market trend, ABS freeze, Bear Stearns slump, Lehman Brothers bankruptcy, Crude Oil spike, Stock Indices crashes, Spread boost, ...)

Central Banks and Authorities Actions

(Fed programs, ECB, SNB programs and other CBs actions, Governments interventions, programs liquidity injections, bail outs, programs Quantitative Easing approach, ...)

Primary Brokers and Dealers

(Merrill Lynch, Bank of America, Citigroup, Fannie and Freddie, AIG, Goldman Sachs, Lloyds, Mitsubishi Group, Washington Mutual, JP Morgan, Unicredit, BNP, Fortis, Wells Fargo, Wachovia, Wall St. CEO resignation, ...)

Financial Institutions

(Madoff Funds, Moody's downgrades, Bear Stearns hedge funds, Citigroup hedge funds, Focus Capital, Tequesta Mortgage Fund, Carlyle Capital, <?xml:namespace prefix = st1 ns = "urn:schemas-microsoft-com:office:smarttags" />Blue River Municipal Bond Fund, Lancelot Investment, ING CDOs fund, ... )

Explaining Central Banks and Authorities programs to stabilize the financial system

Equity markets prices usually anticipate events both looking at relevant stocks and at indexes themselves: see what happened

This web page and its content is performed by Roberto Botter.